1Pay is deploying an integrated capability with a comprehensive EMI offering with international standards and capabilities for a SuperApp processing.

Here are some of the features 1Pay plans to introduce to the Afghanistan market, and gradually, we’ll be adding more value as we grow:

Features of 1PAY

Comprehensive and Integrated App providing multiple payment modes, Account, Wallet and Cards (both physical and virtual).

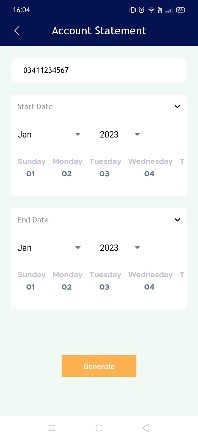

Powerful Administrative and Reporting tools that optimize productivity with online, real- time monitoring and download capability

Ease-of-deployment: Flexible license offering for different deployment approaches

Built-in Anti-Fraud and many other popular value-add modules

Flexible product offering to meeting much wider bank and merchant needs

Support merchant without dedicated server

Quality and experienced local support that can readily offer necessary onsite deployment, configuration support

1Pay Platform Overview

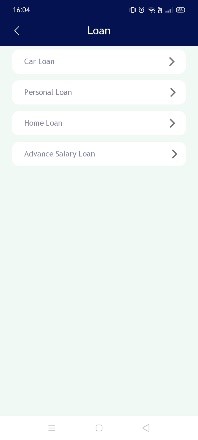

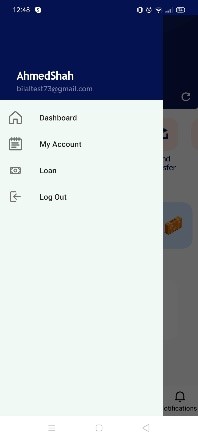

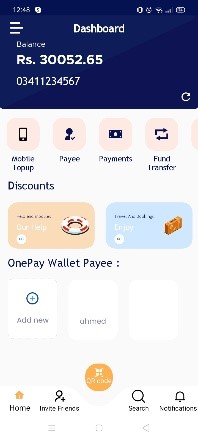

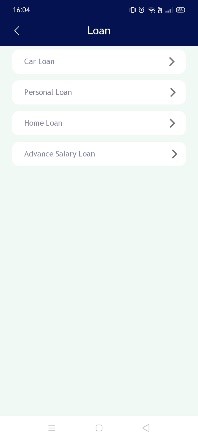

It is a comprehensive and integrated Digital solution for different funding sources (i.e. cards, mobile wallets and bank accounts). Following services or facilities will be offered through the 1Pay Super App.

- Limit Management

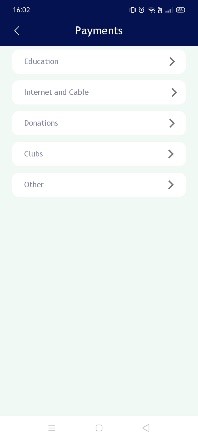

- Payments

- Disbursements

- Utility Bill Payments

- Telco payments

- Government Payments

- Brokerage Payments

- Salary Payments

- QR Retail

- Send Amount to NID

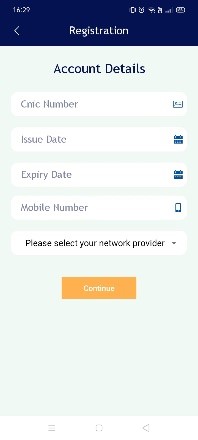

- Customer On-Boarding

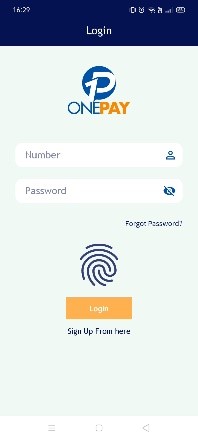

- Login/Login with

- Pin/Bio Verify

- Set / Change PIN

- Account Overview

- Account Linking

- Open Current/Savings

- Account

- P2P Transfers

- Debit Cards Visa

- Biometric based user interface

- Multilingual Interface

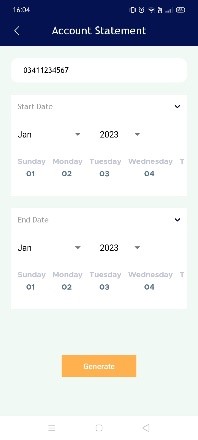

- Reporting Tools – A range of reporting Tools that provide all the information needed to effectively measure and manage transactions (by region, period, currency, transaction mode, and month).

- Telecom Top Up

- Multiple Account Linking

- Loyalty Points (if any)

- QR P2P